Introduction

I wanted to go over something here real quick. I had a new client ask me a question. I thought it was important to share with you my response, edcuate you and give you some peace of mind on this topic. This new client had a business owner’s policy through The Hartford, which is a great company. This new client wanted to know how her policy would respond in the event of a fire to her building. She and her husband owned a building and they conducted business out of the building. So, this is an important asset to them. Click on the video below if you want to follow along that way or read the remainder of this article.

I asked her, “has anyone ever helped you kind of walk through a policy to understand how a business owners policy flows and how the policy covers this peril? She said, “No”.

I thought my walkthrough of her policy would be helpful for you.

There are 3 steps to know if a peril is covered in a business owners policy:

Step 1: What does the insuring agreement say?

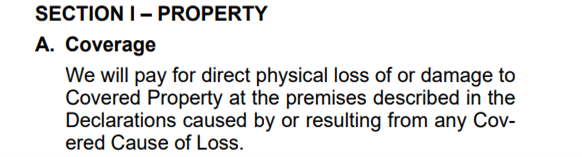

The insuring agreement tells you what the policy does and what the policy covers. It is usually the first paragraph of a policy. Below is a section taken from the ISO BOP policy form – this is a sample BOP form.

The insuring agreement says that the policy will cover loss of the property or damage due to a covered loss. So when you look at the insuring agreement, which starts off the policy, the insuring agreement will address what the policy covers the insured for.

Step 2: The first thing to keep in mind is that the business owners policies (BOP) are written using a special coverage form.

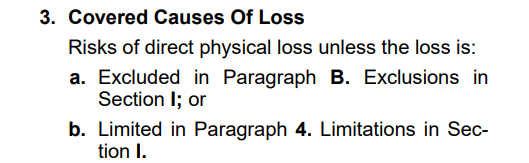

It is important to understand this term. So when you think of BOPs, think of special coverage form. What that means is that the peril in question (in our case fire) would be covered except if it’s specifically excluded in the policy. Getting back to our question about whether fire is covered, we need to see what is the “cause of loss” that the policy covers.

Step 3: What cause of loss is covered?

When we drop down to this part of the policy, we see the following language.

As we talked about with these forms, the loss is covered unless it is excluded in the policy. Next, you have to drop down in the policy to see if the peril (in our case fire) is listed as an exclusion.

Step 3: Is your peril on the list of exclusions?

There’s a separate section in the policy that deals with exclusions, and you have to look in that section to see if the peril is listed. When we drop down to that part of the policy that deals with exclusions. We see, that in this case here, fire is not listed as an exclusion. That means fire is a covered cause of loss or peril that is covered by the policy.

Business owners policies can be confusing because the contracts do not read like a novel. Also, there could be other factors in play that determine whether your peril or condition is covered. Unfortunately, that is how it goes. It is really important for you to take a look at each individual carrier’s BOP policy form because each carrier uses their own form and these forms are not standard across carriers.

If you need help with your business owners policy coverage or if you have questions feel free to reach out to me. 504-256-3048 or mike@pominsurancegroup.com